Starting Your Business in New York: Legal Steps for a Solid Foundation

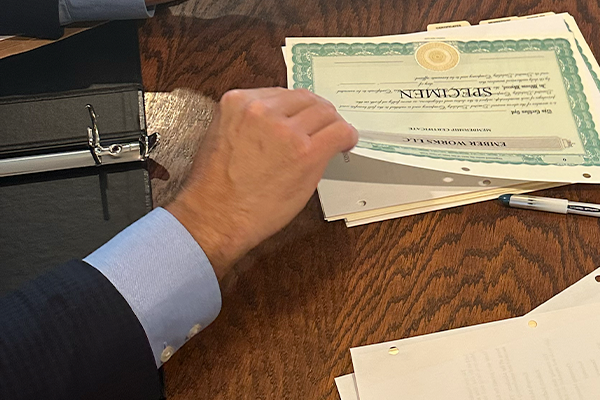

Embarking on the journey of starting a business in New York, from the bustling streets of Rochester to the quaint neighborhoods of Brockport or the broader regions of Monroe County, is an exhilarating venture. It's a path filled with potential and promise, but also one that requires careful legal planning to ensure a solid foundation for your business.

At Klafehn, Heise & Johnson P.L.L.C., we believe in equipping entrepreneurs with the right tools and knowledge to navigate the legal landscape of business setup successfully. Here are the key legal steps to consider when starting your business in New York.

1. Choose the Right Business Structure

Selecting the appropriate business structure is crucial. Each type, be it a sole proprietorship, partnership, LLC, or corporation, has distinct legal, tax, and operational implications. Your choice will affect everything from liability protection to tax obligations and profit-sharing methods.

Action Step: Evaluate the nature of your business, potential risks, and future growth prospects. Consulting with a legal professional can help in selecting the structure that best suits your business needs.

2. Register Your Business Name

Your business name is not just an identifier but also a critical branding tool. In New York, if you want to operate under a name different from your own, you’ll need to make sure you have the legal authority to do so by filing an LLC, corporation or d/b/a ("doing business as") under that name.

Action Step: Check for the uniqueness of your business name to avoid infringement on existing trademarks and/or rejection of the name by the applicable filing authority. Then, form your entity or register your name with the appropriate New York State or county office.

3. Obtain Necessary Licenses and Permits

Depending on the nature of your business and its location, different licenses and permits may be required. This can range from general business licenses to specific permits for regulated industries.

Action Step: Research and understand the licensing requirements specific to your business type and location in New York. Ensure that all necessary licenses and permits are obtained before commencing operations.

4. Understand Employer Obligations

If your business will have employees, there are numerous legal responsibilities to consider, including employment laws, tax withholdings, and workers’ compensation.

Action Step: Familiarize yourself with New York State labor laws and IRS requirements for employers. Implement systems for payroll, tax withholdings, and compliance with employment laws.

5. Set Up Financial Infrastructure

Proper financial management is key to the success of any business. This includes setting up business bank accounts, accounting systems, and understanding tax obligations.

Action Step: Open a business bank account to keep your personal and business finances separate. Consider working with an accountant to set up an accounting system and understand your tax responsibilities.

Rochester, NY Business Attorney

Starting a business in New York is a significant undertaking that requires careful legal planning. By following these steps, you can lay a strong foundation for your business, ensuring compliance with legal requirements and protection of your interests.

If you’re starting a business in New York and need legal guidance, contact Klafehn, Heise & Johnson P.L.L.C.. We’re here to help you every step of the way, from initial planning to ongoing business operations.

Legal Disclaimer: This article provides an overview of the legal steps involved in starting a business in New York and is not intended as legal advice. The specifics of business formation and operation can vary. For personalized legal advice, consult with the professionals at Klafehn, Heise & Johnson P.L.L.C. Portions of this content are considered ATTORNEY ADVERTISING under the New York State Unified Court System Rules of Professional Conduct (22 NYCRR Part 1200). Past results do not guarantee a similar outcome.

‹ Back